Digital payments are exchanges of funds carried out via the Internet or other mobile platforms. Digital payments are more efficient, practical, and safe than traditional ones because they don’t require checks or real money. Online shopping, paying bills, sending money, and using a mobile wallet are just a few examples of digital payments. Users can transmit money electronically or carry out financial transactions on their smartphones through mobile applications known as “payment apps”. These apps are made to provide a safe and practical alternative to making payments using cash or actual cards. Following are a few examples:

1. PayPal

People and businesses can safely send and receive money using PayPal, an established online payment system. Customers connecting their bank accounts to PayPal can use that information to buy goods or send money to other people.

2. Venmo

Cash can be sent and received from close friends and family using Venmo,a digital wallet. Customers who link their bank accounts and credit or debit cards to their Venmo accounts can send money to other Venmo users. Venmo users have the option to share prices and make purchases from sellers.

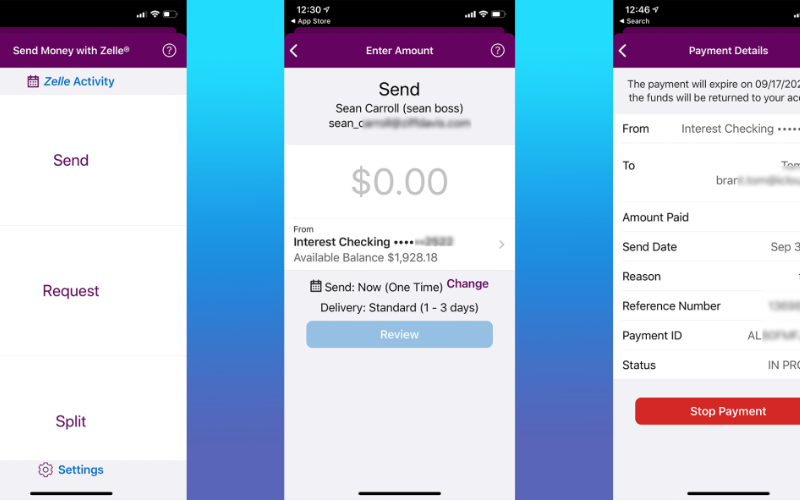

3. Zelle

Through their bank accounts, consumers can send and receive money through the digital wallet Zelle. To send and receive money, all you need is an email address or mobile number. Large US banks support Zelle, making it a well-liked option for sending payments swiftly.

4. Cash App

Users of the Cash App mobile payment app can send and receive money fast and easily. It has features including the ability to purchase and sell Bitcoin, get direct transfers, and invest in equities, and is especially well-liked in the US. To utilise the app and make purchases or ATM withdrawals, users can also create a free debit card.

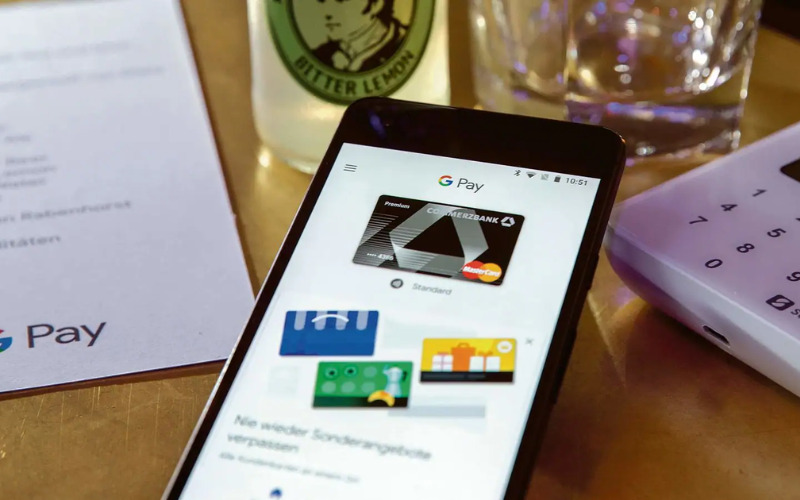

5. Google Pay

Google developed Google Pay, a digital wallet and online payment platform. Users can securely store their credit and debit card information and use their mobile devices to make online and offline purchases. Money transfers between people are also possible using Google Pay.

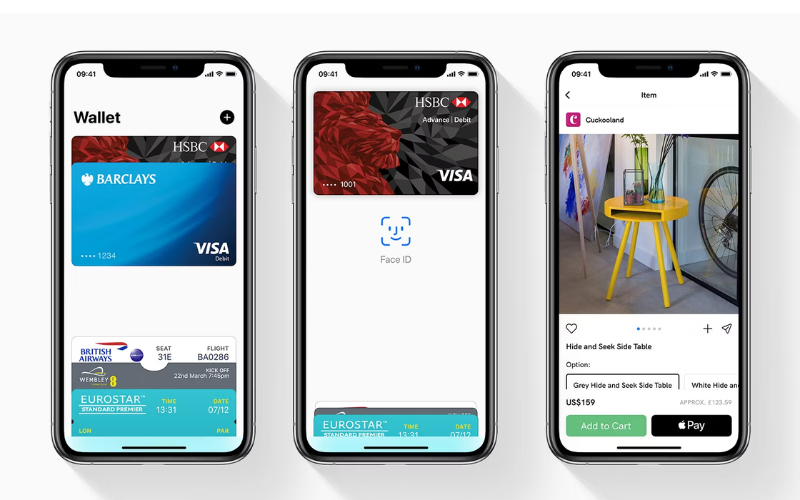

6. Apple Pay

A mobile payment and digital wallet service created by Apple are called Apple Pay. With their Apple devices, consumers may securely save their credit and debit card information and make purchases both online and off. Additionally, Apple Pay may be used to transfer and receive money between people as well as to make purchases on applications and websites that accept it.

7. Samsung Pay

Customers can use their Samsung smartphones, tablets, and wearables to make payments with Samsung Pay, a mobile payment service. Due to its support for both NFC (Near-Field Communication) and MST (Magnetic Secure Transmission) technologies, users can make payments at a range of merchants, including those without NFC terminals.

8. Payoneer

With the help of the payment platform Payoneer, companies and independent contractors can obtain payments from customers and marketplaces all around the world. It offers a variety of payment alternatives, including local bank transfers, international bank transfers, and prepaid debit cards. Tools are available for managing payments, invoices, and tax compliance.

9. Skrill

Skrill, a digital wallet, its users may send and receive money from anywhere. Bank transfers, credit/debit cards, and local payment methods are only a few of the available payment methods. It provides a prepaid Mastercard that may be used for ATM withdrawals and shopping.

10. Stripe

Stripe is a payment processing platform that allows businesses to take payments online. Credit/debit cards, Apple Pay, and Google Pay are just a few of the payment methods it accepts. Invoicing, subscription billing, and fraud prevention are other capabilities that Stripe provides. Developers can incorporate payment processing into their applications using Stripe’s API.

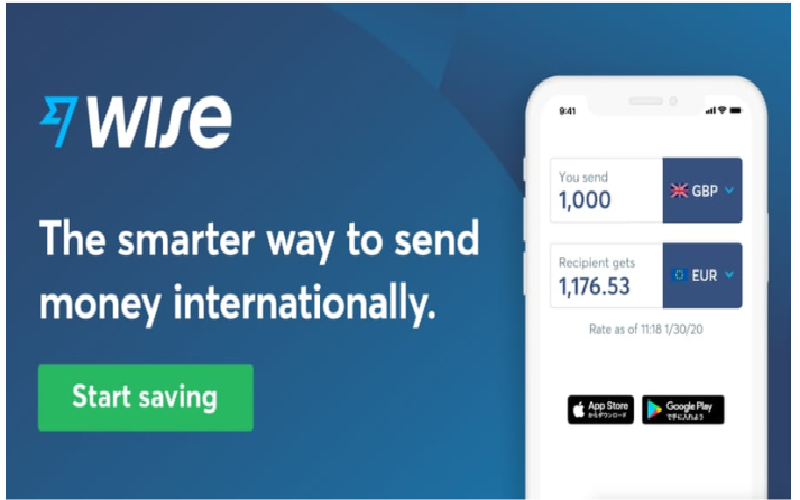

11. TransferWise

TransferWise is a digital payment service that enables users to transfer and receive money globally with cheap costs and near-to-mid-market exchange rates. Peer-to-peer technology is employed to connect users looking to swap currency. Additionally, TransferWise provides users with a multi-currency account that enables them to store and manage money in several currencies.

12. Dwolla

Dwolla is a digital payment platform that allows companies to transmit, receive, and process payments. It provides ACH payments, which are electronic transfers between American bank accounts. In addition, Dwolla provides features like rapid bank verification, mass payments, and white labeling.

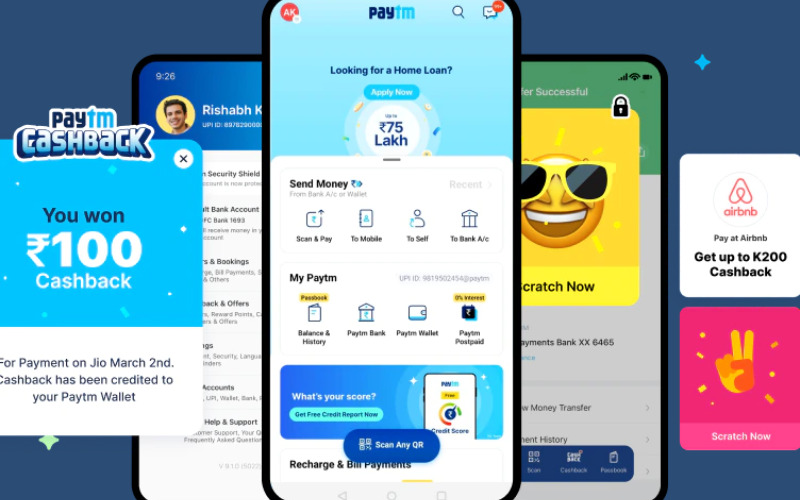

13. Paytm

Paytm provides financial services and mobile payments. Users can transmit money to other Paytm users and make purchases through it. It also offers ticket booking, insurance, and bill payment.

14. WeChat Pay

A mobile payment and digital wallet service is called WeChat Pay. It can be used to transmit money to other WeChat users, pay for goods and services, and make both in-person and online purchases. Bill paying, foreign money transfers, and investment management are some of the services provided.

15. Alipay

China-based Alipay is a mobile and online payment system. Ant Group now runs it; Alibaba Group originally built it. It enables users to send money to other Alipay users, makes payments online and in person, and access additional financial services including loans, insurance, and wealth management.

16. Amazon Pay

Amazon Pay is used to make online purchases. Credit and debit cards saved by users can be used to make purchases on different participating websites and apps.

17. Masterpass

Masterpass is the brand name for Mastercard’s digital wallet and payment system. Users can use it to make purchases both online and offline by storing their payment and delivery information in one convenient place. In addition to additional security measures, it also provides extra incentives like rewards and discounts.

18. Visa Checkout

A digital wallet and payment service is called Visa Checkout. Users can use it to make purchases both online and offline by storing their payment and delivery information in one convenient place. Additional benefits of Visa Checkout include heightened security protocols and expedited checkout procedures.

19. American Express App

Users can manage their accounts, view transactions, and send payments using American Express through the American Express App, a mobile application. It also includes attributes like account notifications, rewards monitoring, and access to personalised offers and recommendations.

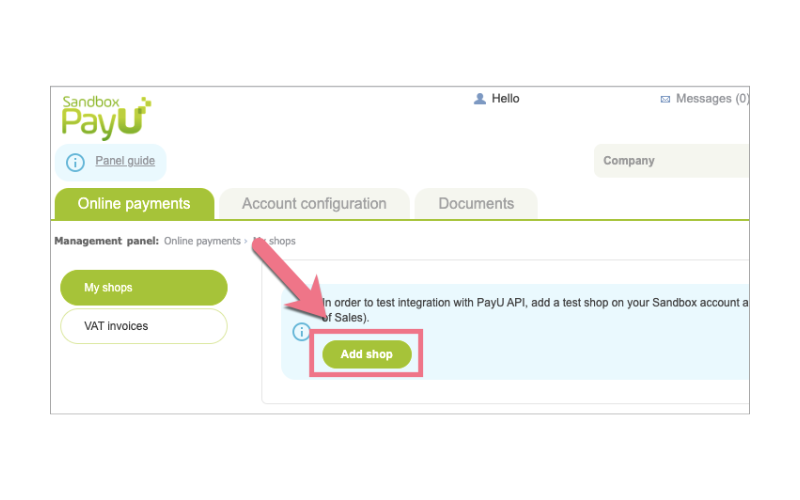

20. PayU

Fintech company PayU offers payment options to both consumers and companies. POS systems, mobile payments, and internet payments are just a few of the many payment-related goods and services it provides. In addition to these functionalities, PayU also provides customer service, risk management, and fraud defence.