In this fast-pacing world, with vast regular expenses, we sometimes lose track of how much our pocket can allow us to spend. It becomes tedious to save for major future expenses and live within the means. The extensive daily calculations seem far-fetched after a while, and we are back to square one. With the advent of technology, we can easily say goodbye to such problems. Numerous applications keep you intact with the budget you want for yourself and help you keep track of your extravaganza.

This article discusses the top 20 applications so you never go bankrupt, even for a day.

1. You Need A Budget (ynab)

This application is a godsend. While it may charge you a fortune, the features will make all the money spent on it seem worth it. The application syncs your bank account and renders two ways of entering the data, i.e. manually or via importing. Though the working of the application is a bit difficult to get on your own, the company helps in teaching the same via extensive video guides. Not only do the application keep track, but it also imparts the much-needed comprehensive education on handling finances.

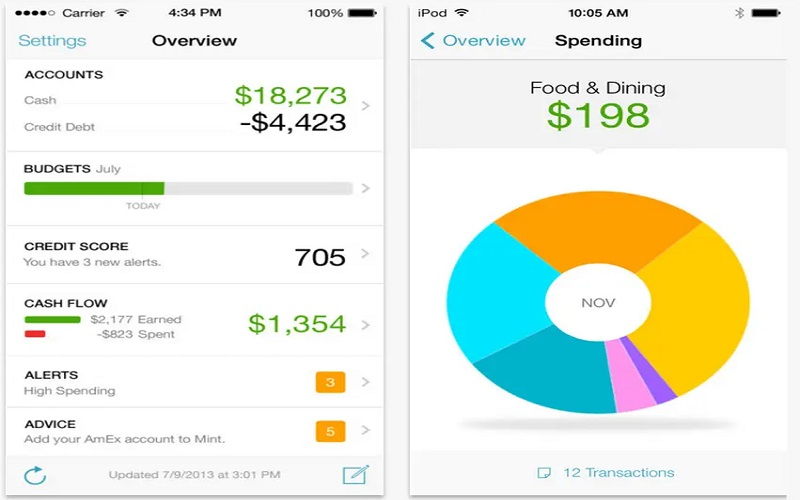

2. Mint

This is the best-in-town free application to improve the spending habit of the Bassanio in you. It, like YNAB, comes with two options for entering the expenses, one via importation of data through bank sync and the second via manual registering. This application is embedded with reminders so you don’t miss any important bills, along with many free educational resources such as a home loan calculator, loan calculator, etc. However, since this is a free application, you might be bombarded with many targeted financial product advertisements.

3. Simplifi By Quicken

Simplifi helps you to stay in touch with your cash flows. It allows you to sync your bank account and automatically categorizes your expenses into recurring bills and subscriptions, along with giving the user insight into upcoming bills. This application comes with a 30-day free trial period and is paid. However, unlike YNAB, it charges less of your fortune. It arranges a customized budgeting template for each user and thus gives personalized attention to your cash flows.

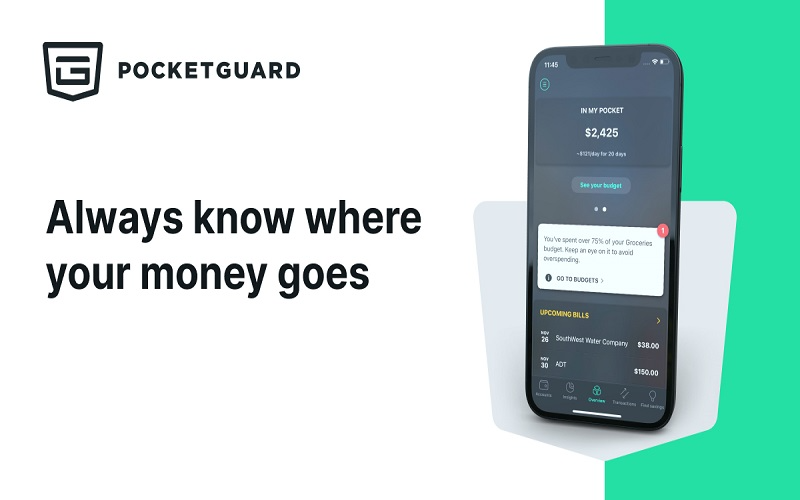

4. Pocketguard

Do you always end up with piles of credit card bills or debts? Well, this application comes in handy to curb your problem of overspending. Pocketguard comes with both the free version and the premium version. It helps connect multiple bank accounts and, thereby taking into consideration all the expenses and income sources, build a budget and put forth the maximum daily spending limit. It also has a feature that allows the users to save for future goals by filling the jar little by little every day.

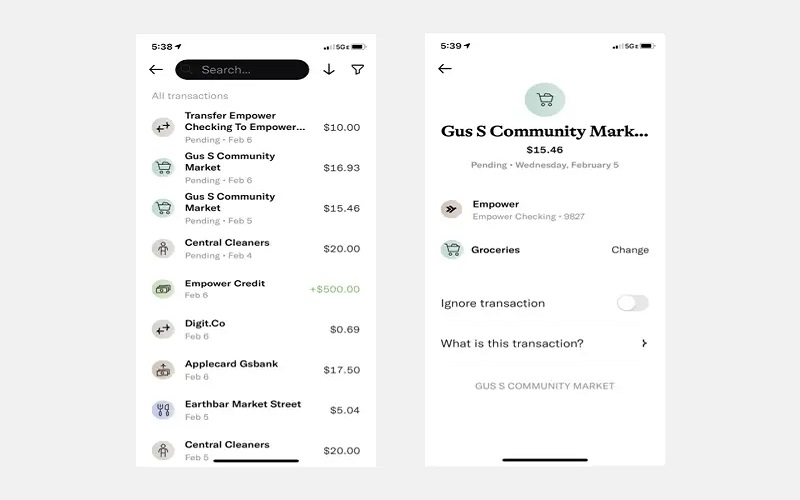

5. Empower

This application is for those who are looking to build themselves a chunk of wealth. This is not like a regular budgeting application, although it helps in comparison to spendings inter-temporally. There happens to be no option of entering the expenses and income manually and therefore, users have to sync their accounts. However, such is not the case when it comes to investment accounts. The application allows users to enter their investment portfolio manually. It also helps analyze the trends in the user’s portfolio and bestow many investment plans like retirement planning, education planner tool, etc.

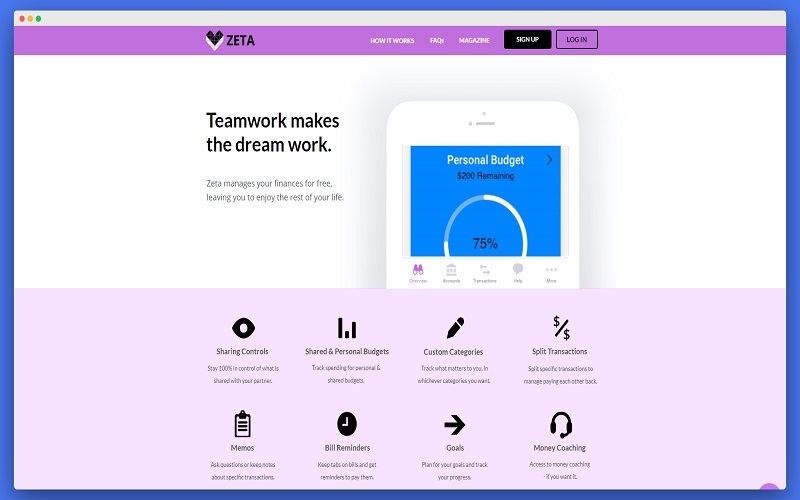

6. Zeta

Do you wish to say out loud, “Let’s go Dutch”, every time you and your partner go out on a date? Well, modern problems require modern solutions. This application is specially made out for couples. It provides the feature of opening a joint bank account to keep split and manage the spending and income. Since the joint account feature is the essence of this application, it comes with a various rare options like sharing controls, shared and personal budgets, bill reminders, and more.

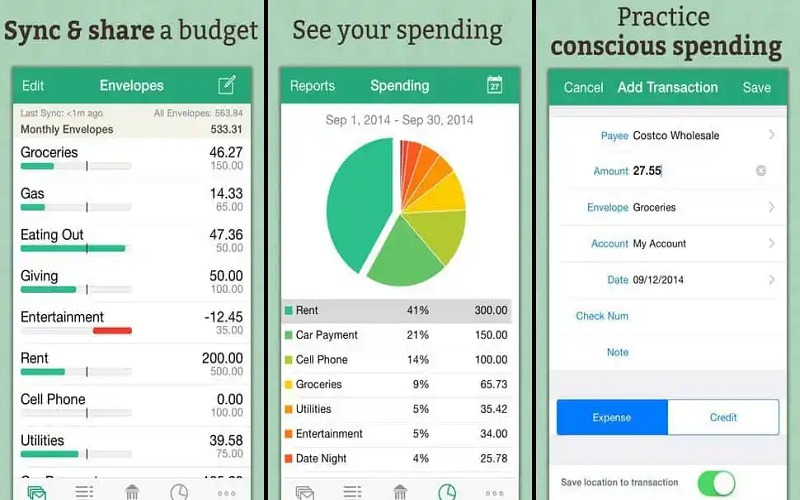

7. Goodbudget

This application doesn’t allow its users to sync in the bank account; rather have them enter the data manually. It works on an envelope budgeting approach wherein the users can assign a particular amount of money to different spending categories. The unpaid version of this application comes with limited envelopes or classes, one account, and that too on just two devices, unlike the paid version that allows up to five devices.

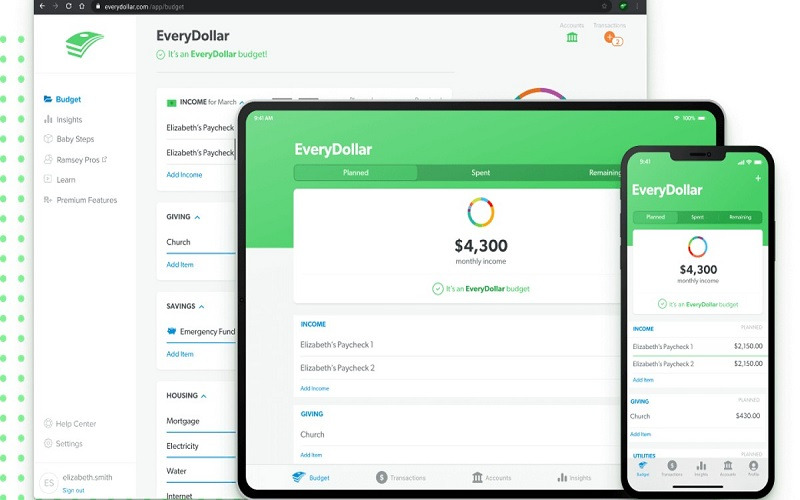

8. Everydollar

This application, in its free version, doesn’t allow users to sync their bank account but instead asks them for manual labor. However, the paid version is less troublesome, enabling the users to connect through their bank accounts and provide custom reports and recommendations on spending habits. The premium version is a bit pricey for an affordable budgeting application, whilst the unpaid version is pretty basic.

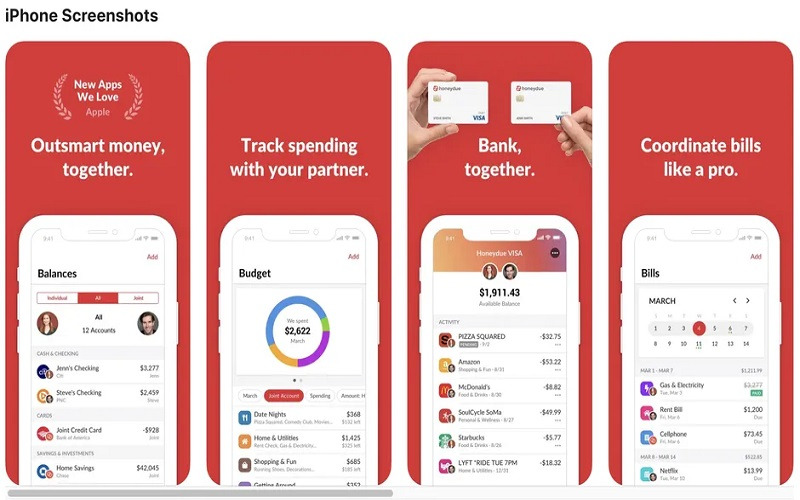

9. Honeydue

Another application for partners or couples in a pipeline is Honeydue. The users have to connect their savings, loan, and credit card accounts and can thereby see each other financial position through one app. This application focuses on making a user learn from their experience rather than planning ahead of time. It categorizes the expenses for you but also leaves you enough space to make up your categories. The cutest feature of the application is it lets you chat with your partner and also allows you to send emojis.

10. Fudget

Do you identify yourself as old school? Would you rather have a pen-paper approach than delve into a complex world of application? This application is for people like you. It has a straightforward process wherein the users cannot sync their bank accounts and instead have them enter all the data manually. It doesn’t have any budget categories too. However, one can find a few upgraded features in the paid version.

11. Stash

Several budgeting tools, a taxable brokerage account, a debit card that rewards you with stocks when you use it for purchases, and a virtual checking account are all included when you sign up for Stash. The bank account Stash offers include passive saving in addition to having no overdraft fees, no minimum balance requirements, no hidden costs, and checks received through direct deposit are obtained up to two days earlier.

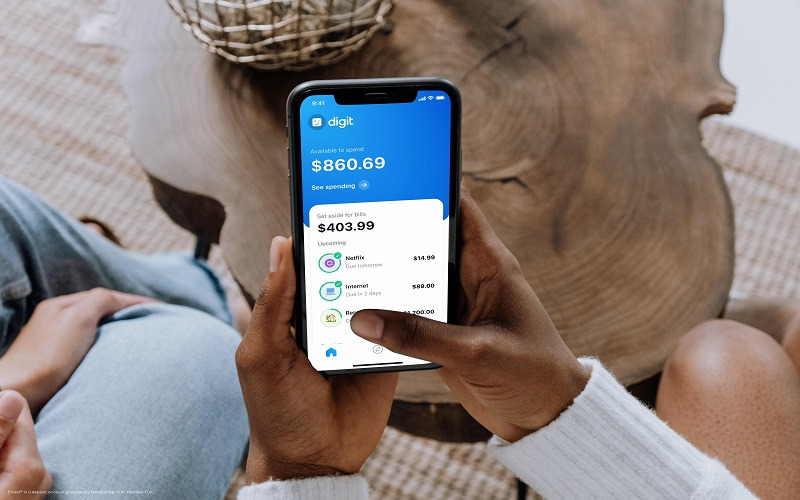

12. Digit

This application helps the user achieve their goals. All they need to do is put in the money they require to accomplish a particular target and the date by which they need to have the sum. Digit automatically provides the user with a daily saving amount bringing you a step closer every day.

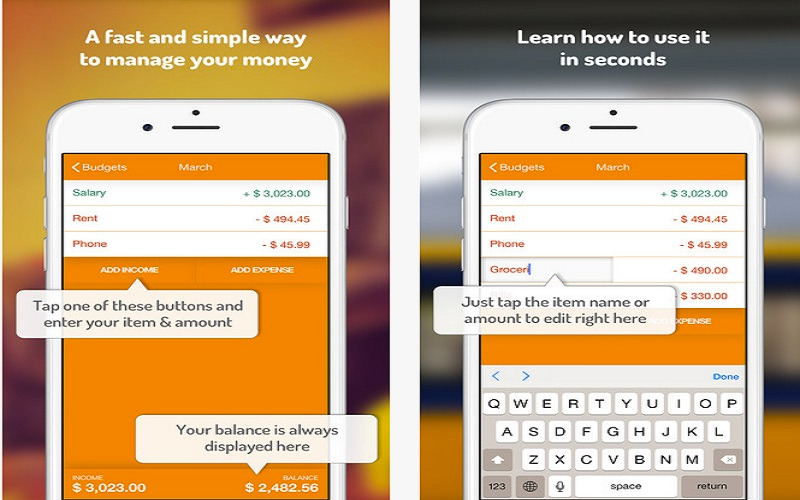

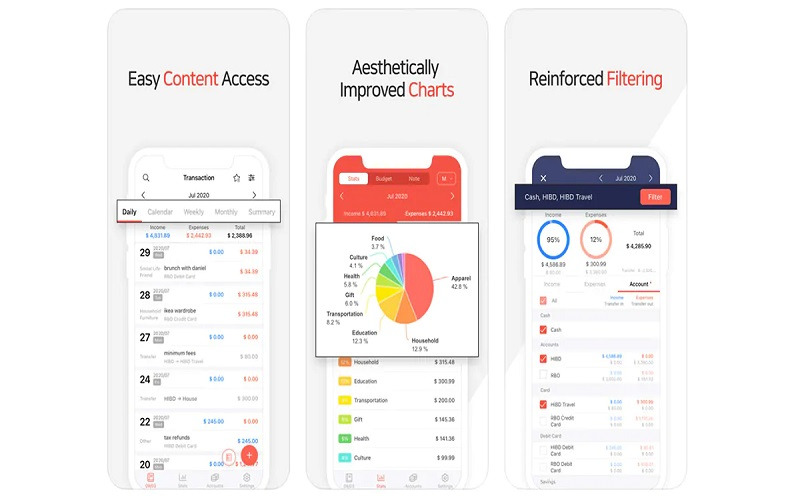

13. Money Manager

The user can classify expenses using the Money Manager App depending on the days, weeks, months, and years. You can input your income, expenses, and total savings. In addition, you may create a budget, make notes, and see cost information. Utilize a separate tab to keep track of your assets and liabilities.

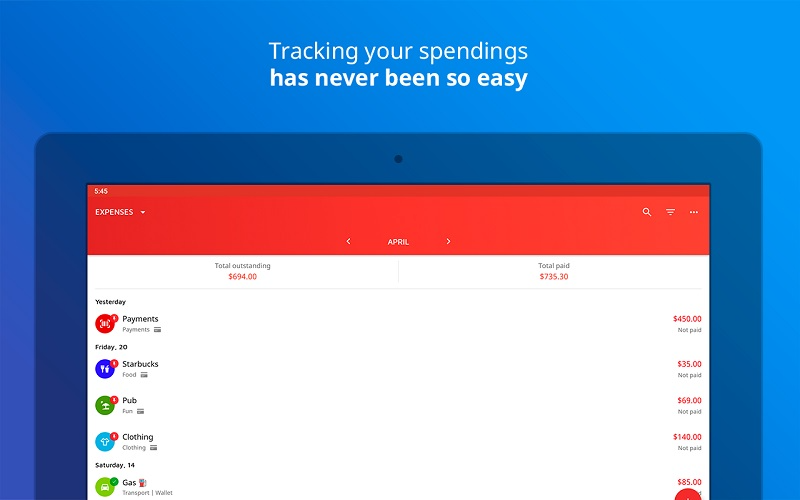

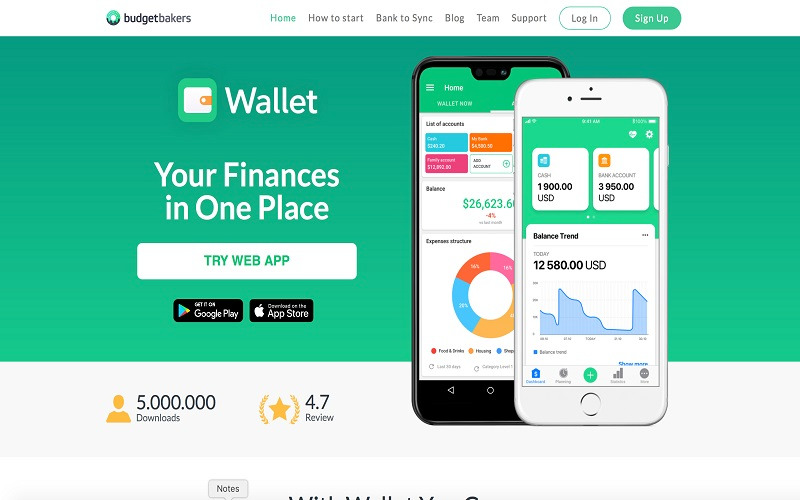

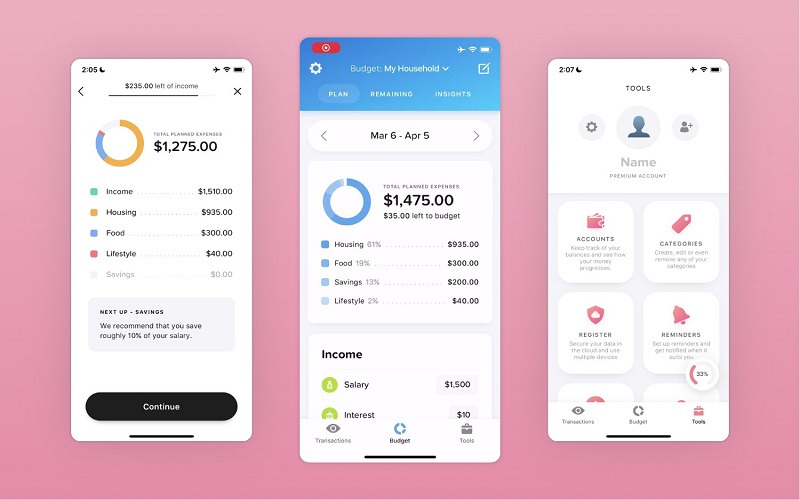

14. Wallet

This application, like others, helps in keeping track of your expenses. However, it comes with a feature of cloud synchronization, which won’t let you start all over again in case you lose or buy a new phone. It also gives visual insights into all the incoming and outgoing money.

15. Buddy

Along with providing the basic calculator risqué, this application has an additional feature of helping the user split the bill among their friends. This application also provides a detailed overview of all the expenses the user has done in a month. It has state-of-the-art visuals and an extremely light interface.

16. Spending Tracker

Spending Tracker is another application to make saving a hassle-free adventure for you. This application represents the statistics of your budget in an easy-to-understand way. Along with this, there is no limit on the number of entries you can register.

![]()

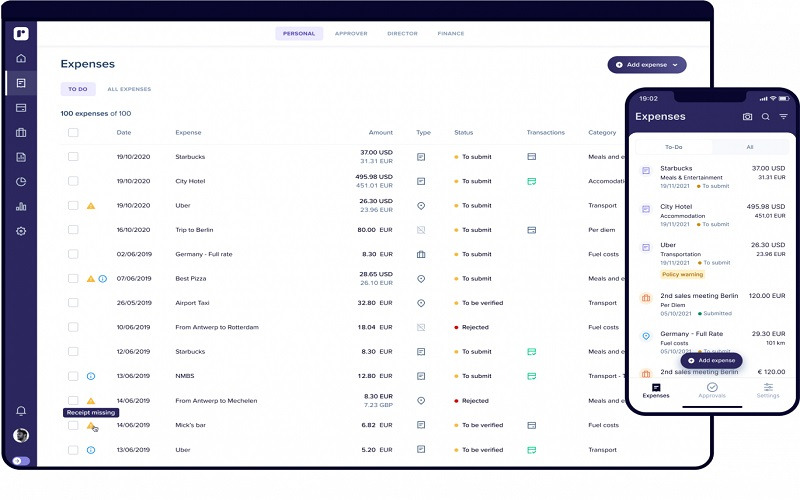

17. Rydoo

This application uses a futuristic approach in the entry of expenses. It allows the user to scan the receipt and will enable them to manage everyday expenditures. This also bodes well with international travelers as the application comes with the feature of changing the currency as needed.

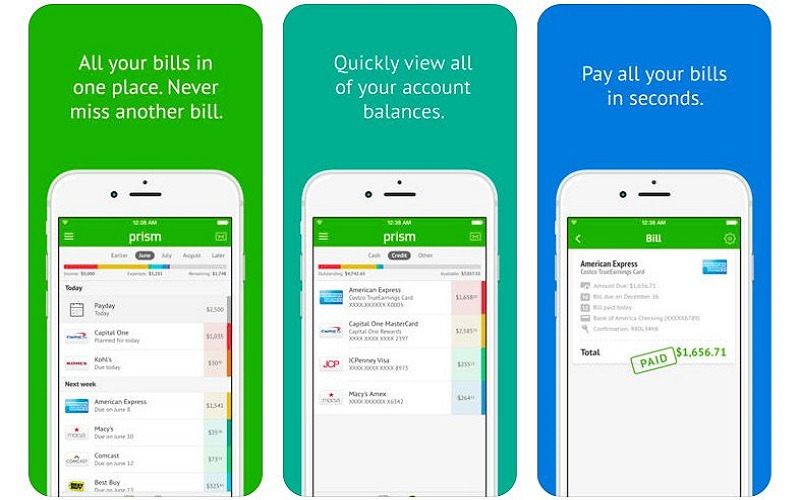

18. Prism

This application helps you to keep track of your budget while simultaneously sending out reminders to pay bills so that the user does not have to pay late surcharges. This application can also deliver the bills independently as per the user’s requirement.

19. Spendee

The unique feature of this application is that it allows the user to create a wallet with their roommate or family to manage the combined household expenses. It sends the user’s bill reminders; however the unpaid version of it asks the user to enter data manually.

20. Mobills

The app shows you how much money is still available for each budget area, so you may control your spending as necessary. The interactive charts in Mobills’ budgeting software let you examine your financial situation and make adjustments as required to achieve your longer-term financial objectives.